31+ mortgage points tax deductible

Ad We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund. Ad Finance raw land with fixed or variable rates flexible payments and no max loan amount.

Home Mortgage Loan Interest Payments Points Deduction

Youre using a cash method.

. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. They must deduct the remaining points over 360.

Try our mortgage calculator. Of the loan principal one point equals 1. If you bought a home.

Web Discount Points Deductions. If the amount you borrow to buy your home exceeds 750000 million. Web Up to 25 cash back So you might have to pay four points to reduce your rate by a full percent.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Are mortgage points tax deductible. To see if mortgage points are worthwhile you.

Web Also with all possible tax deductions your first priority is most likely to save money and earn tax advantages. Web Mortgage points are optional fees paid to the lender to lower the interest rate. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

Unfortunately most home loans have between. Here are the specifics. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

Web For mortgage interest to be deductible the mortgage must be secured by your home and the proceeds must be used to build buy or substantially improve your. Thanks to the Mortgage Insurance Tax Deduction Act of 2021. The Points system is a fee charged by mortgage lenders.

Taxes Can Be Complex. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Web Up to 96 cash back You can fully deduct mortgage points in the year you paid them if all of these apply.

Say you buy one point on a mortgage loan of 300000 which costs. Note that that credit will drop to 22 for installation after Dec. For instance paying one point for a 300000 30-year fixed-rate.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web Generally the IRS allows you to deduct the full amount of your points in the year you pay them. Usually your lender will send you.

Get an idea of your estimated payments or loan possibilities. Web Most homeowners can deduct all of their mortgage interest. Web SOLVED by TurboTax 3116 Updated November 16 2022 Yes you can deduct points for your main home if all of the following conditions apply.

You secured the mortgage loan with your main. However higher limitations 1 million 500000 if married. Mortgage points which are also known as discount points are fees that home buyers pay to lenders for a lower interest rate.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. And they can be tax deductible. For this purpose do the groundwork.

Web While the per-point interest rate discount varies by lender its typically a 025 reduction. Mortgage points are considered prepaid interest and are tax. Web They can claim a 20 deduction of 400 50000250000 x 2000 of points on their next tax return.

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Web How much does 1 point lower your interest rate.

Homeowners who are married but filing. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Homeowners who bought houses before.

Ad Use AARPs Mortgage Tax Calculator to See How Mortgage Payments Could Help Reduce Taxes. Web Mortgage points are considered an itemized deduction and are claimed on Schedule A of Form 1040.

Mortgage Interest Tax Deduction What You Need To Know

Benefits Of Passive Income To Earn More Money Quickly Tax Explained

Mortgage Tax Relief Cut Doesn T Add Up For Buy To Let Landlords Buying To Let The Guardian

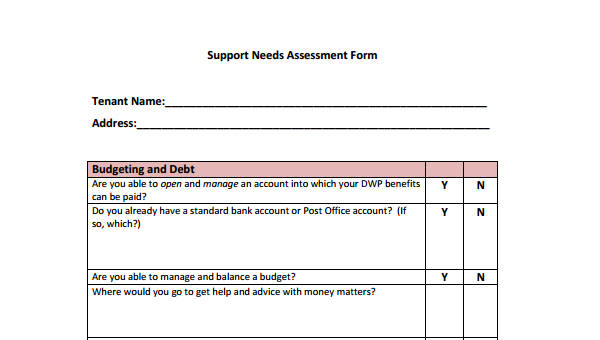

Free 31 Needs Assessment Forms In Pdf Excel Ms Word

Alankit Group Information

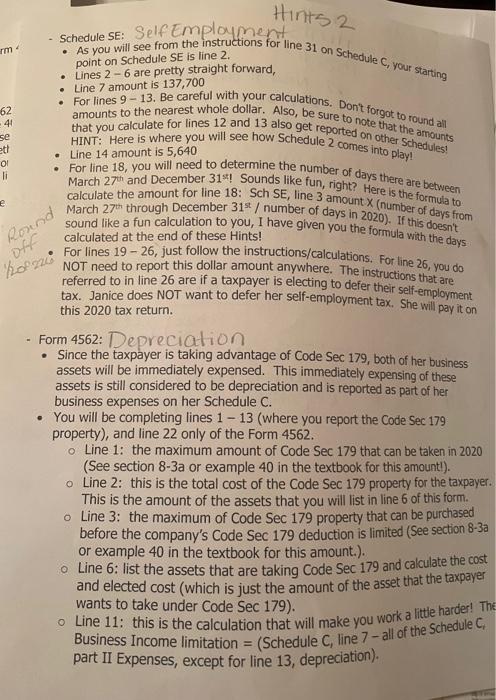

Solved All Listed Forms Will Be Used With An Agi Check Chegg Com

Document

6102 M 72 E Williamsburg Mi 49690 Zillow

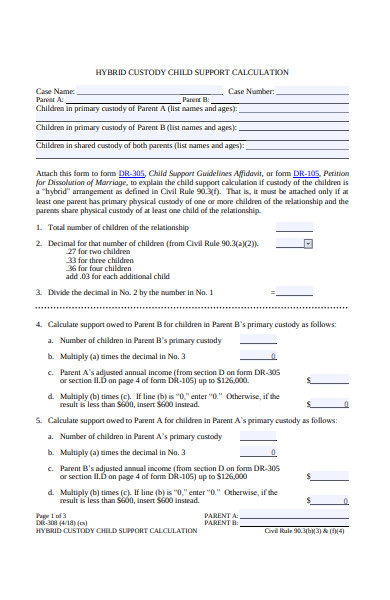

Free 31 Calculation Forms In Pdf Ms Word

Study Of Small And Medium Enterprises In Azerbaijan Ifc

31 Money Receipt Templates Doc Pdf

Star Equipment Rental Guide By Winsby Inc Issuu

Free 31 Job Assessment Forms In Pdf Ms Word

13336019 Jpg

Free 31 Employment Application Sample Forms In Pdf Ms Word Excel

Airline Miles And Hotel Points Give Your Travel Plans More Flexibility

Papers Past Parliamentary Papers Appendix To The Journals Of The House Of Representatives 1915 Session I Education Higher Education In Continuation Of